Who Are We?

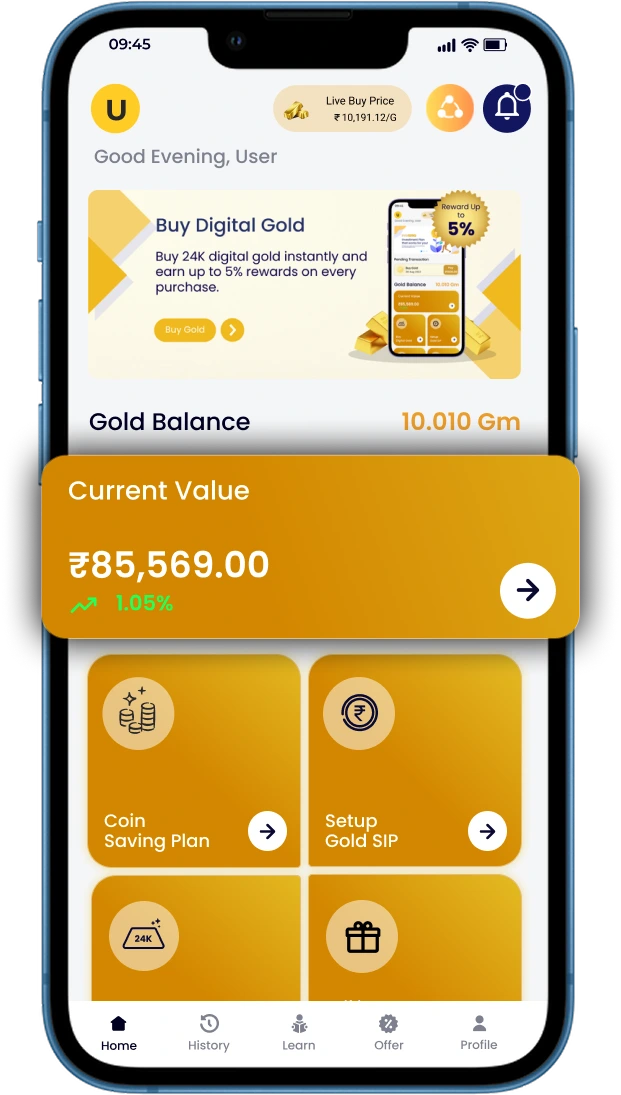

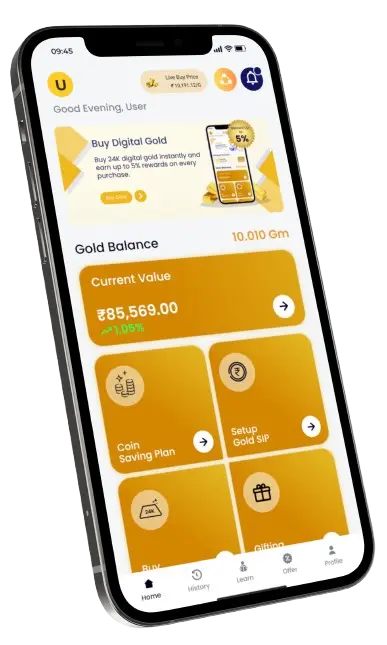

At PayGro, we believe that investing in 24K digital gold should be simple, secure, and accessible to everyone. Our app is among the top trusted digital gold apps in India, offering flexible investment options.

Our platform lets you effortlessly buy, sell, and grow gold through one-time purchases or automated SIPs—daily, weekly, or monthly.

With PayGro, build your gold savings at your own pace through secure, transparent investments backed by trusted partners and real-time pricing.

Why Choose PayGro?

Smart Gold SIPs

Investing in digital gold seamlessly with automated SIP options.

Secure & Transparent

100% our gold, backed by trusted vaults.

Flexibility

Start small and accumulate gold over time.

Instant Liquidity

Sell your gold anytime, hassle – free.

PayGro is India’s leading platform to buy 24K digital gold online, start digital gold SIPs, and track daily digital gold prices.

Whether you want to compare digital gold apps in India, invest in gold systematically, or convert digital gold to cash – PayGro makes gold investment simple and secure.

Buy Digital Gold Instantly

With PayGro, purchasing 24K digital gold is quick, secure, and transparent. Whether you’re looking to invest a small amount or make a large purchase, PayGro lets you buy gold online anytime at live market prices.

Every gram of your digital gold is backed by real, stored physical gold with trusted custodians in India, ensuring purity and safety.

Start a Digital Gold SIP

Make gold investment a habit with PayGro’s Digital Gold SIP. Set your preferred investment frequency — daily, weekly, or monthly — and watch your gold savings grow automatically.

Starting at just ₹10, a gold SIP helps you build long-term wealth in 24K pure digital gold without market timing worries.

PayGro in News

PayGro recently had the privilege of engaging with brilliant minds from IIT WashU, who took a deep dive into PayGro’s business model and mission.

Their analysis brought forward powerful ideas to:

- Strengthen user trust

- Upgrade our technology and user experience

- Identify new ways to scale and drive revenue growth

With their fresh perspective and strategic insights, we’re more confident than ever in our journey to make digital gold investment easy, accessible, and rewarding for all.

At PayGro, we’re not just building a platform—we’re building the future of micro-investing in India.

Contact us

+91-86000001 52/ 53

Flat No. 101, 102, Kundan Heritage, Anupam Nagar, Bopodi, Pune, Maharashtra 411003